Overview (REGION-SPECIFIC)

EMEA

Bancontact QR

Learn more

Please note, that this payment method is available only in Netherlands and Belgium.

Bancontact QR Code payment is a feature that allows consumers to make payments by scanning a QR code displayed at the point of sale or on a website or mobile app. This payment method enables quick and convenient transactions for both online and offline purchases.

Please note that our payment SOAP API only supports passthrough scenario where the 3-D Secure authentication is handled by an external 3DS provider.

Guides:

Bancontact Wallet Initiated Transaction (WIP)

Learn more

Please note, that this payment method is available only in Netherlands and Belgium.

Bancontact Wallet Initiated Payment (WIP) is a payment method that allows consumers to make payments directly from a digital wallet application. WIP allows for a seamless and convenient transaction process, as users can pay for goods or services by simply selecting the Bancontact option within their wallet app, without the need for physical payment cards or entering card details manually. WIP can be initiated as merchant or cardholder initiated payment.

Blik

Learn more

Please note, that this payment method is available only in Poland.

Blik is one of the most popular payment methods in Poland allowing users to make instant payments with their banking application covered by all major Polish banks.

Guides:

Click To Pay

Learn more

Mastercard Click to Pay (C2P) is a digital payment solution offered by Mastercard. It allows consumers to make secure and convenient online purchases without the need to enter their payment and shipping information for each transaction. With C2P, users can store their payment details securely and use them across participating online merchants, making the checkout process faster and more streamlined. It provides a seamless and consistent experience across devices and platforms, giving users peace of mind and convenience when making online purchases.

Mastercard C2P can also be used for other card brands than Mastercard (e.g. Visa or American Express).

Guides:

EV Charging via ECOM rails

Learn more

There are two approaches to execute an ecommerce payment for EV-charging.

In all scenarios the sender should include the EVSE-ID into the payment request. This allows you to only work with an already-known ID by the EV-charging platform. Fiserv will map the EVSE-ID to a terminal ID that can be used in the payment request to the authorization system.

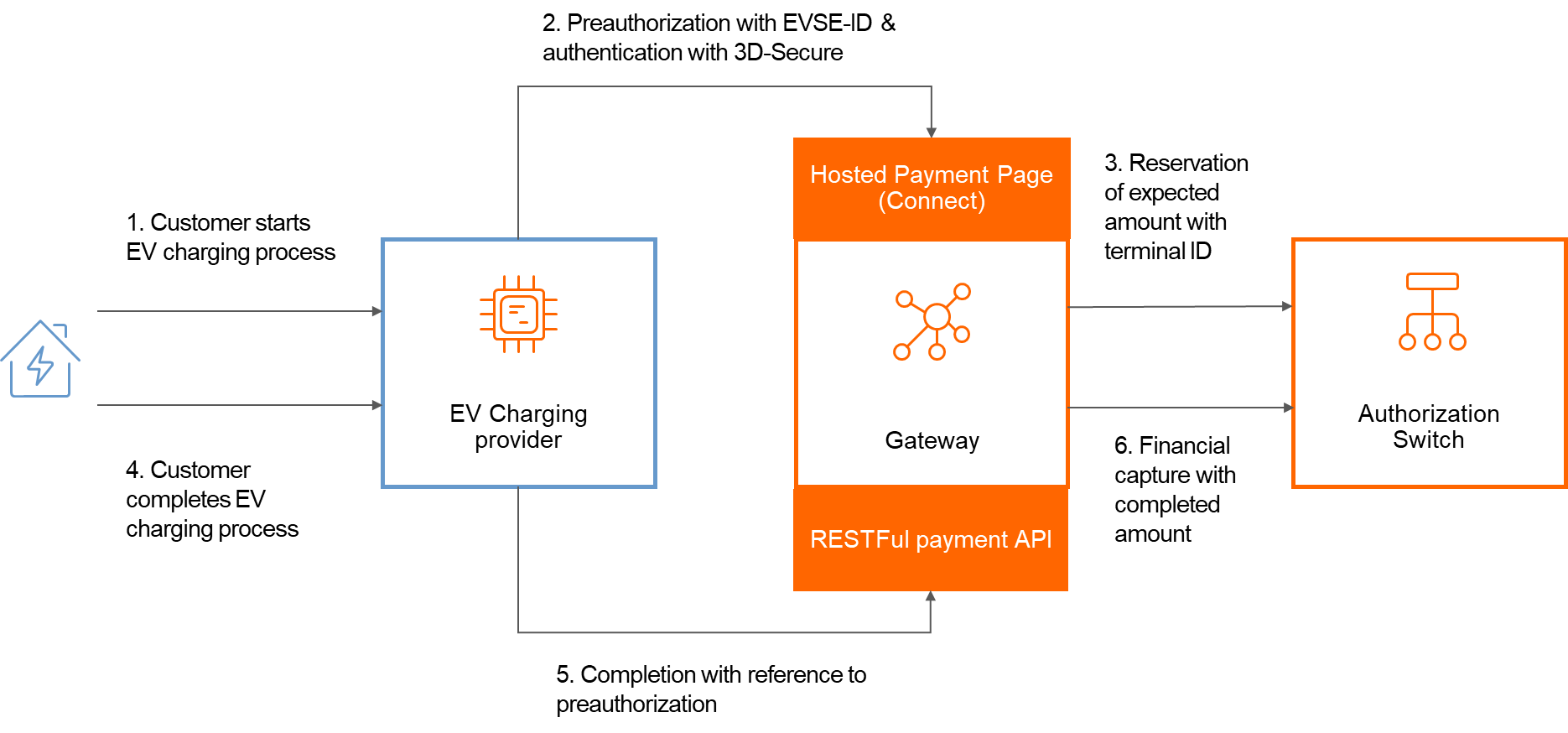

Option 1: Preauthorization followed by preauthorization completion

This option allows us to guarantee that the cardholder has enough funds on this account.

Step 1: Execute a preauthorization via Hosted Payment page (Connect)

- Include the EVSE-ID in the field

terminalID - Optional: Include the EVSE-ID in the field

customerid(if you desire to receive a report containing the EVSE-ID) - Details about Connect can be found here: link

Step 2: Once the preauthorization is completed and the cardholder has performed the authentication via 3d-Secure (if needed), you will receive a notification to the URL provided in CONNECT request.

Step 3: As soon as the EV-charging process is completed, you will need to send a preauthorization completion via RESTful payment API.

- Endpoint: Submit secondary transaction

- Use

requestType‘PostAuthTransaction’ - Include the EVSE-ID in the object

terminalId - Optional: Include the EVSE-ID in the field

order.billing.customerId

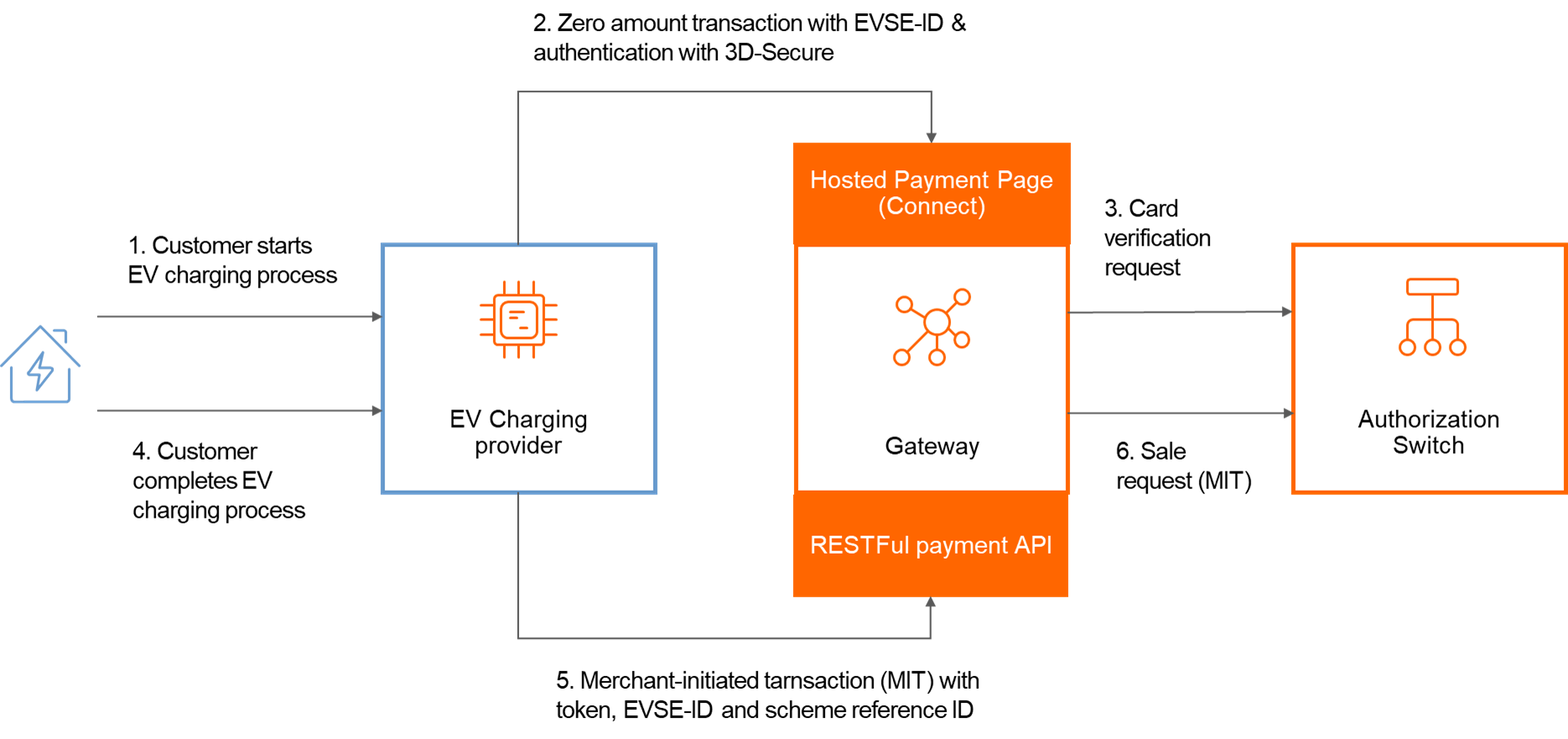

Option 2: Account/card validation (zero amount transaction) followed by sale transaction using a token

This option allows you store the card details in form of a token, so that it can be reused for future transactions.

Step 1: Execute a zero-amount transaction via Hosted Payment Page (Connect)

- Include the EVSE-ID in the field

terminalID - Optional: Include the EVSE-ID in the field

customerid(if you desire to receive a report containing the EVSE-ID) - Details about Connect can be found here: link

Step 2: Once the zero-amount transaction is completed and the cardholder has performed the authentication via 3d-Secure (if needed), you will receive a notification to the URL provided in CONNECT request

Step 3: As soon as the EV-charging process is completed, you will need to send a sale request via RESTful payment API

- Endpoint: Submit primary transaction

- Use

requestType'PaymentTokenSaleTransaction' - Include the EVSE-ID in the object

terminalId - Include the scheme reference ID from the customer-initiated transaction in the object

schemeTransactionId - Optional: Include the EVSE-ID in the field

order.billing.customerId

giropay

Learn more

Please note, that this payment method is available only in Germany.

giropay will be decommissioned on December 31, 2024

See official communication by Giropay (in German): https://www.giropay.de/faq/das-zahlverfahren-giropay-wird-eingestellt-was-bedeutet-das-fuer-mich-als-haendler.html

Giropay is a German payment method based on online banking allowing customers to use direct transfers from their bank account.

Guides:

iDEAL 2.0

Learn more

iDEAL 2.0 is a popular payment method used in the Netherlands that allows consumers to make online payments directly from their bank accounts.

With iDEAL 2.0, users can select their bank during the online checkout process and initiate a payment directly from their bank's secure environment. The payment is confirmed in real-time, providing a seamless and convenient payment experience for both consumers and merchants.

Guides:

MCC Mandates

Learn more

For UK-based Financial Institutions with Merchant Category Code 6012, Visa and Mastercard have mandated additional information of the primary recipient of the loan to be included in the authorization message.

Guides:

PayPal

Learn more

This functionality is only available through selected distribution channels in EMEA region.

In case you are integrated with PayPal Legacy solution, you are required to migrate to PayPal Checkout solution upon your earliest convenience. Please reach out to your customer service team for assistance.

PayPal is a widely recognized and trusted online payment system that allows individuals and businesses to make secure transactions over the internet. It serves as an alternative to traditional payment methods, such as cash, checks, or wire transfers. With PayPal, users can create an account linked to their email address and add their preferred payment method, such as a bank account or credit/debit card. Once the account is set up, they can use it to send and receive money online.

PayPal provides a convenient way to make payments for online purchases, send money to friends or family, and receive payments from customers or clients. It is accepted by numerous online merchants and service providers worldwide.

New PayPal framework adheres to the latest compliance and security standards and offers smoother checkout process with the lightbox.

Guides:

PayPal Recurring Payment (Billing Agreement)

Learn more

The creation of a PayPal Billing Agreement can be done via our Hosted Payment Page (Connect).

Based on the PayPal Billing Agreement you are allowed to trigger recurring or subsequent payments via our RESTful payment API. You can also use the RESTFul payment API to cancel a Billing Agreement.

Guides:

SEPA Direct Debit

Learn more

SEPA (Single Euro Payments Area) Direct Debit is a payment method that allows individuals and businesses in the SEPA region to make electronic payments directly from their bank account to another bank account. SEPA is a European initiative that aims to harmonize payment transactions across participating countries, making it easier and more efficient to make cross-border payments within the Eurozone.

Please note that SEPA Direct Debit can either be used through direct approach (only in Germany) or through Fiserv's local payment offering.

Guides:

Visa Mobile

Learn more

Please note that this payment method is available in Poland only.

Visa Mobile is a virtual wallet allowing consumers to approve their payments in mobile application, without codes or additional verification. The cardholders simply register their Visa card together with their mobile phone number.

Guides:

APAC

Guest Checkout Tokenization

Learn more

As per Reserve Bank of India (RBI) compliance requirements, storing card on file data has been limited. As an alternative solution, a guest checkout transaction token provided by schemes have been introduced as Alternate IDs (Alt ID). In order to request Scheme Alt ID and cryptogram, you need to send an action request to the Gateway. The call to retrieve scheme ALT ID and cryptogram is made by our system automatically.

Please note that this feature is applicable for Mastercard, Visa and Amex only.

RuPay

Learn more

RuPay is a payment method that is owned and operated by the National Payments Corporation of India (NPCI). It is an Indian domestic card scheme that allows individuals to make low-cost electronic payments at various merchants and retailers across India.

Guides:

NORTH AMERICA

Debit Disbursement

Learn more

Refer to the following information only when you are operating in the US and your store is enabled to allow credit transaction processing.

Debit Disbursement (Visa OCT, MasterCard MoneySend) allows businesses to disburse funds in real-time, directly to a debit card. Faster payouts can increase loyalty and satisfaction, reduce costs for businesses. The Debit Disbursement solution is cheaper, faster, more convenient and more traceable than traditional payment methods. It facilitates payments and transfers such as:

• Fund disbursements by e-commerce marketplaces

• Government disbursements (such as VAT refunds)

• Forex and binary option trade payouts

• Affiliate and contractor payouts

• Expense reimbursements

• Corporate and manufacturing rebates

• Insurance claims

The functionality for disbursements can be used with Direct Post and hosted payment page integrations. It is also available for REST API originated transactions.

The funding source may be a credit card, debit card, prepaid card, or bank account, but the receiving account must be a debit card. Note currently only Visa and MasterCard brand debit cards can be used as the recipient for debit disbursements.

For person-to-person payments (P2P) and Person to Person Bank Initiated (P2PBankInit), you must perform the operation as two individual transactions, one for funding (Pull transaction to debit funds from sender) and one for disbursement (Push transaction to receive funds by receiver).

Disbursement types supported:

• P2P - Person to Person

• P2PBankInit - Person to Person Bank Initiated

• MerchDisb - Merchant Disbursement

• FundsDisb - Funds Disbursement

• Pay Roll Pension Disbursement

• MerchInitMT - Money Transfer – Merch Initiate

Pull transactions for getting funds from the sender can be done using the transaction type ‘sale’, while Push transactions for the disbursement to the receiver using the transaction type ‘credit’.

When building a request for Pull transaction apart from the mandatory fields required for Sale transaction, you can also need to include some custom fields in your transaction request.

Guides:

Updated 5 days ago