Payment Lifecycle

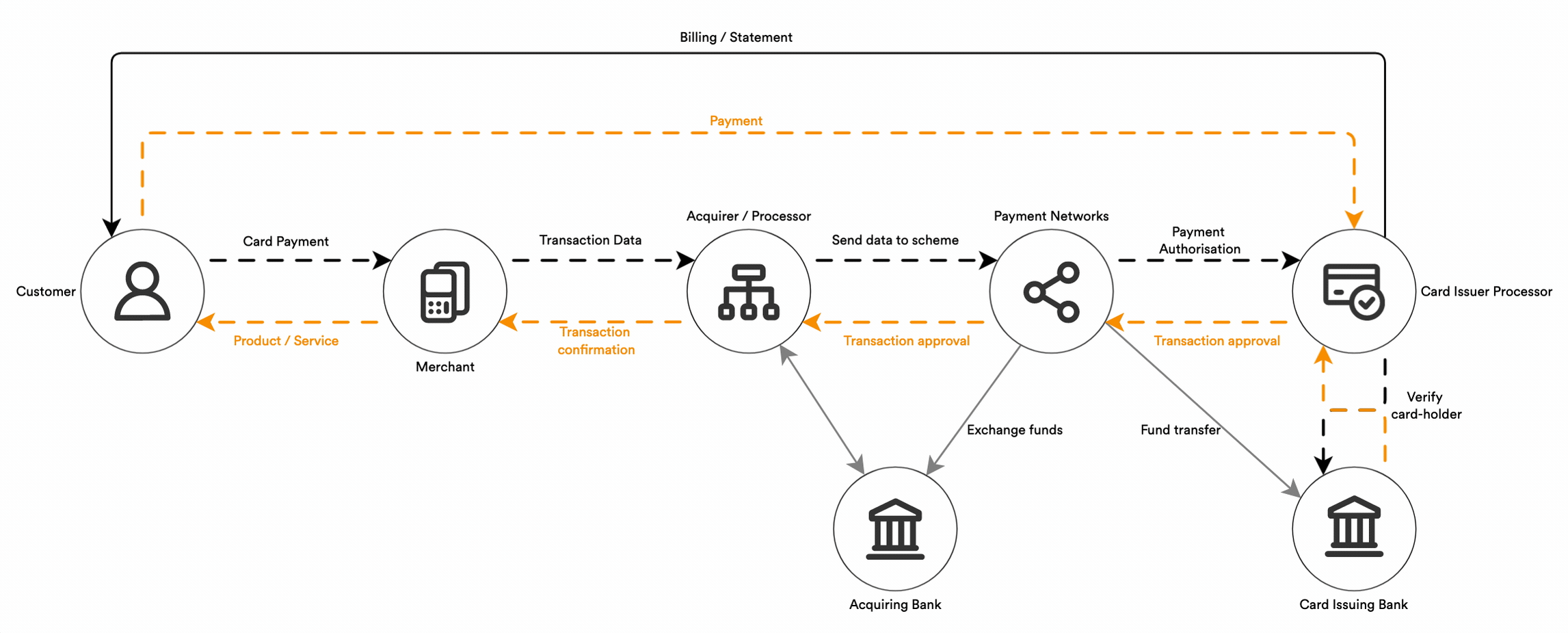

The payment lifecycle can seem complex, this section aims to give a good overview of this and explain what data is stored and accessible via these APIs.

Authorisation

The first stage of the payment lifecycle involves a customer providing a form of payment, in this case a card. The card will go through an initial process called Authorisation which involves the Merchant passing the details across via the Acquiring Bank to the Issuing Bank in order for it to be verified, checking things such as:

- The customer has sufficient funds

- The interactions looks legitimate or fraudulent

Once a decision has been made, it will either be approved or declined with a reason. If it has been approved, the customer has completed their part of the interaction and it will move onto the next stage. In either case, we store an Authorisation record which is available via the /authorisations endpoint.

Note that a Pre-authorisation is a type of authorisation message that serves to hold a set amount of funds that may later change, for example pay-at-pump petrol stations, or a hotel reservation. In these cases, additional authorisation messages may follow to increase or decrease the amount, then finally a 'completion' which finalises the authorisation.

Clearing

The second stage, this involves a Merchant formalising the authorisation into a Transaction and indicating that money is ready to be moved from the customers bank account to the merchants bank account. Payments that have been cleared will be available via the /transactions endpoint.

Note, that in some cases, 'single message' transactions may be used, this means the authorisation and clearing message is sent all at once. The alternative, as described above, is referred to as 'dual message'. However, in both cases we retain a record for each of the stages.

Settlement

This is the act of money being moved from the customers bank account (Issuing Bank) to the merchants bank account via the Acquiring Bank. Any fees will be taken by each party during this process, such as the interchange fee going to the card scheme. We call the final step of this process, where the money moves into the Merchants bank account, Funding. These records contain details about total amount funded minus fees, are usually batched on a daily basis, and will soon be retrievable via the /funding endpoints

Updated over 2 years ago